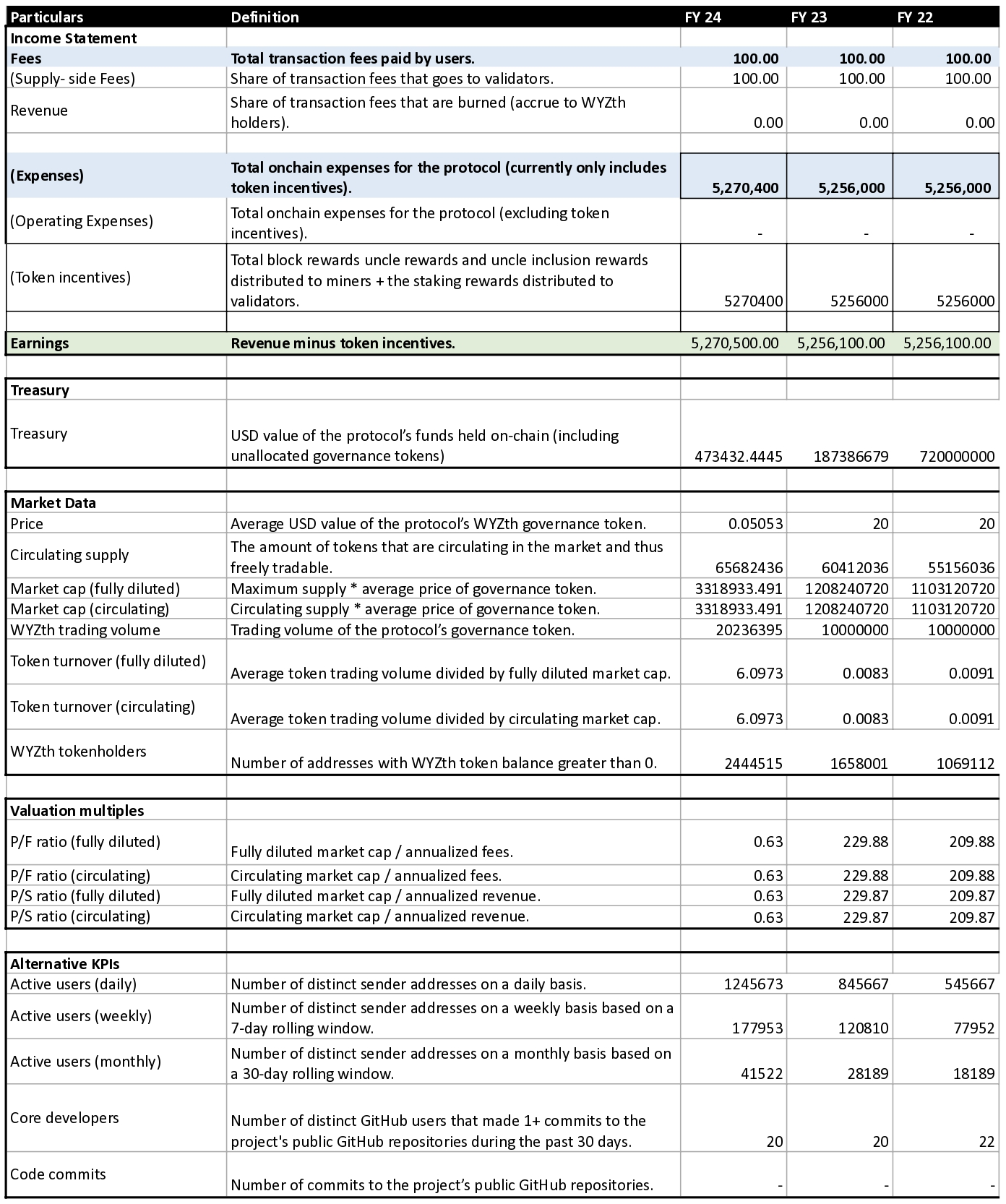

WYZth Financial Report 2022-2024

WYZth Compliance Yearly Report 2022-2024

Disclaimer

This Yearly Report provides details on the status of WYZth as of the end of 2024. The information presented herein does not constitute any legal liabilities. The WYZth Foundation is included in this report.

The document has been prepared based on actual WYZth coin transactions (hereinafter referred to as "WYZth") since the premine (50 million WYZth were minted during the initial issuance, and mining commenced thereafter).

As of September 2024, WYZth has been listed on 14 exchanges, which has contributed to increased accessibility and liquidity.

This report adheres to the revised WYZth White Paper policies, including tokenomics and governance frameworks, for the financial year ending 2024. Any updates to these policies will be incorporated into future publications. All data in this report is presented in WYZth, rounded to two decimal places. Totals may not sum precisely due to rounding. .

✨ WYZth Labs published Financial Report in leading Newspaper of Asia-Pacific (India edition) on the 16th January 2025 🚀

Download Article

WYZth Distribution

Annual Mining Report

A total of 50 million WYZth was mined annually during this period.

Staking Burn Initiative

As part of the WYscale Staking Initiative, 50 million WYZth from pre-mining reserves will be burned, reinforcing our commitment to sustainability and tokenomics optimization.

WYZth Total Supply

WYZth tokens have an unlimited total supply, governed by mechanisms to ensure ecosystem stability.

Note: The WYZth PoA Layer 1 blockchain produces one block in every 12 seconds, with a mining reward of 2 WYZth per block. This efficient mining mechanism results in an annual production exceeding 5.2 million WYZth, driving sustainable growth and network scalability.

Governance and Validators

WYZth governance ensures transparency and decentralization through its validator network. Key governance highlights include:

- Active participation from validators in policy-making.

- Improved network security and scalability.

Usage and Staking Details

Our Trusted Partners

Trusted Investors

Victus Capital

IBC Group

Accounting Partners

Cryptoworth

Wallet and Integration Partners

DeBank

Rabby Wallet

CEX and Analytical Partners

CoinMarketCap

XT Exchange

and 10+ additional exchanges

Circulating Supply

This report follows the Circulating Supply Guidelines outlined in the WYZth Vesting Plan 2021 (amend Jan 2025) .

Conclusion

The WYZth Foundation remains committed to transparency, innovation, and ecosystem stability. With the support of our trusted partners and stakeholders, WYZth continues to evolve as a leading decentralized asset.

For further updates and details, refer to the revised WYZth White Paper or visit our official platforms.